AI agents at work

– 11 min read

Navigating the future of insurance: The role of generative AI in claims management

Imagine a world where insurance claims are processed with lightning speed, precision, and a personal touch. Where policyholders feel valued and insurers operate with peak efficiency and integrity. This isn’t just a dream — it’s quickly becoming a reality thanks to the power of generative AI.

As we navigate a landscape brimming with challenges — from the financial upheavals of fluctuating interest rates and inflation-driven claim increases to the non-financial perils of climate catastrophes — generative AI stands out not just as a tool, but as a revolutionary force in the insurance industry.

The latest insights from McKinsey reveal that while generative AI promises to redefine risk assessment and claims management, it also brings its own set of challenges, such as ensuring fairness, safeguarding privacy, and fortifying security. For insurers, the way forward is to embrace this new technology and start using strong ethical practices and risk management strategies from the start.

Let’s dive into how generative AI is setting the stage for a transformative era in insurance claims management, making processes smarter, faster, and more attuned to the needs of today’s policyholder.

- Generative AI is transforming claims management by automating tasks, improving accuracy, and ensuring compliance.

- Challenges in insurance claims management include operational efficiency, fraud detection, and regulatory compliance.

- Generative AI can create personalized communications, analyze data, and ensure compliance in claims management.

- Key considerations for using generative AI in claims management include product insight, legal compliance, brand consistency, and data security.

- WRITER, an enterprise-grade generative AI platform, offers features like image analysis, customer call summaries, document analysis, and Ask WRITER to streamline claims management processes.

The challenges of modern insurance claims management

Charting the turbulent waters of insurance claims management requires a keen understanding of its inherent challenges. Here’s what insurers are up against:

Operational efficiency

Managing a high volume of claims with efficiency is more than a goal — it’s a necessity. While the volume of claims has always been on the rise, the four years following COVID have seen record numbers. In the auto insurance industry, the average payout has risen by 35%, reaching $25,000 per claim on third-party bodily injury claims.

Delays and errors do more than just rack up costs; they chip away at the bedrock of customer trust and satisfaction. Insights from industry giants like McKinsey suggest that embracing advanced analytics and AI could be the game-changer, streamlining operations and slashing the time and errors tied to outdated manual processes.

Fraud detection

Unmasking fraudulent claims is a high-stakes endeavor that’s as complex as it is critical. Deceptive practices not only bleed the financial health of insurance companies dry but also unfairly bump up premiums for the honest policyholder. A 2024 study from the Association of Certified Fraud Examiners (ACFE) says that by 2026, 83% of companies will use generative AI to fight fraud. These technologies aren’t just tools but watchdogs, adept at sniffing out the subtle patterns and anomalies that might point to fraud, thereby boosting the precision and speed of fraud detection systems.

Regulatory compliance

Staying in step with the ever-shifting dance of regulations is no small feat. It demands constant vigilance and a hefty investment of resources. Industry experts stress the vital role of technology solutions that don’t just respond to changes but anticipate them, ensuring systems and processes are always a step ahead. This proactive approach minimizes the risk of falling foul of compliance and the hefty financial penalties that can follow.

In the intricate dance of insurance claims management, these challenges are partners that require a delicate balance. By using new AI technology and smart analytics, insurers can not only solve these problems but also make them opportunities for new ideas and better service.

Generative AI functions in insurance claims management: Create, analyze, govern

The capabilities of generative AI can be summed up in three key functions: create, analyze, and govern. Each function has distinct implications for how insurers can handle claims, from automating repetitive tasks to producing outputs that comply with regulations.

Create

Imagine a tool that not only speeds up the creation of everything from letters to payment authorization documents in insurance claims, but also makes each communication unique to the person who gets it. That’s what generative AI brings to the table. It’s like having a super-efficient digital assistant that can quickly pull together evidence, analyze witness statements, and craft detailed investigation reports. Even more, it can interpret images or other visual data to assess damages. This AI capability ensures that communications such as emails and text messages aren’t only standardized but also dispatched promptly to keep policyholders informed and engaged.

Analyze

Here’s where generative AI really flexes its muscles. For insurance teams, analyzing claims means looking through a lot of data — from policyholder information to medical records — to make sure claims are processed quickly and accurately. Generative AI dives into this data, identifying the right responses, spotting market trends, predicting outcomes, and even sniffing out potential fraud by detecting unusual patterns. It’s like having a detective on the team who can also summarize vast amounts of documentation, making regulatory audits less of a headache and decision-making sharper and more effective.

Govern

In the world of insurance claims management, playing by the rules isn’t just good practice — it’s essential. Generative AI steps in as a vigilant overseer, automating compliance checks, spotting violations, and pinpointing risks. It meticulously analyzes insurance contracts and other regulatory documents to ensure that the practice matches the policy, keeping everything in line with industry standards. This not only reduces the risk of costly penalties but also gives big returns on investment across claims management, improving operational efficiency and changing the sector.

Key considerations and requirements for using generative AI in claims management

As you dive into the world of generative AI for your insurance claims management team, it’s crucial to grasp both the power and the boundaries of what it can do for you. Here’s what you need to keep in mind:

Deep product insight: Your AI tool should know everything there is to know about your insurance products. Every piece of content and decision it makes should mirror the complexities of what you offer.

Legal and regulatory compliance: The maze of laws and regulations governing your operations is complex. Your AI should not only be familiar with these but navigate them effortlessly, ensuring you stay on the right side of the law.

Brand consistency: Every communication crafted by your AI solution needs to sound like it came straight from you. It’s about keeping that personal, human touch your customers have come to expect in every interaction.

Style alignment: All content produced by your AI solution should stick to your company style guide, ensuring your voice is consistent across all materials, no exceptions.

Seamless workflow integration: Integrating AI into your existing workflows should be smooth. The solutions are built for easy adoption, allowing you to start seeing benefits right away.

Adaptable to multiple data formats: Your AI must adeptly handle and process the specific data formats that are common in your industry, ensuring it works effectively.

Claims detection and fact verification: Engineered to spot legitimate claims and perform accurate fact-checks, your AI needs to minimize the risk of errors and fraud.

Data security: Keeping your company’s and customers’ data safe is critical. Your AI systems should come with strong security features to protect this essential information.

By focusing on these key areas, you can use the power of generative AI to boost your claims processing operational efficiency, accuracy, and regulatory compliance, paving the way for a stronger, customer-centric future.

Actionable use cases for WRITER in claims management

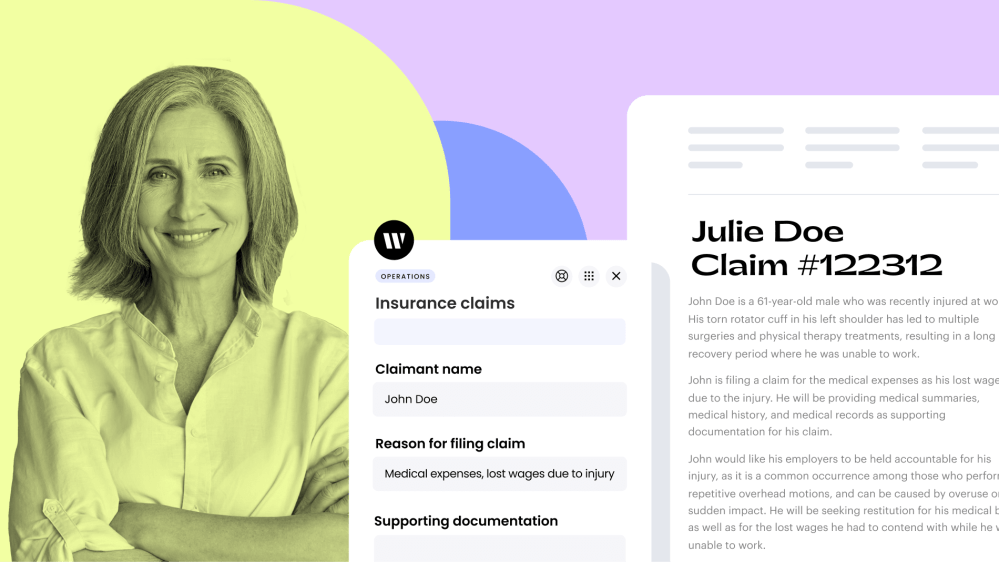

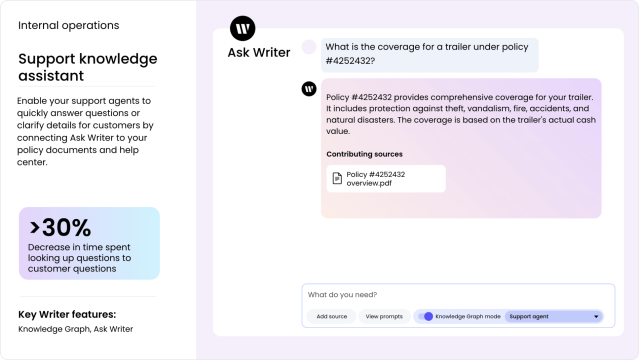

Our enterprise-grade generative AI platform, WRITER, is designed to streamline claims management processes for insurance companies. WRITER automates claims processing by generating tailored content and reports, compiling evidence, analyzing witness statements, and producing comprehensive investigation reports. It speeds up and standardizes customer communications, automatically generating email and text message updates. The platform also analyzes critical data points like policyholder information and medical records to make accurate decisions about payments and services, predict future claim outcomes, and detect potential fraud.

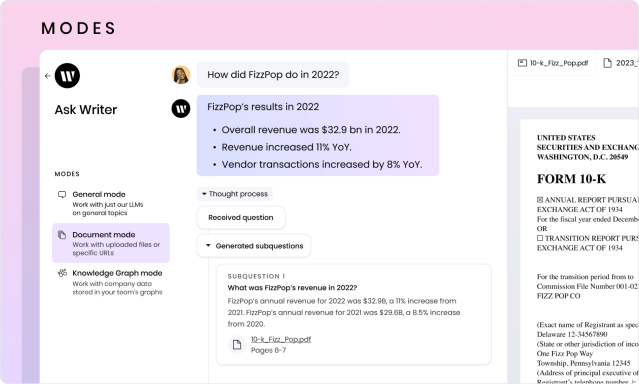

WRITER offers several features beneficial to claims management teams, including a prebuilt chat interface for real-time inquiries, an image analyzer, AI guardrails for compliance and accuracy, and a Knowledge Graph for retrieving precise company data. With AI Studio, insurance claims teams can build no-code custom AI apps that accelerate workflows and tailor outputs unique to your company’s needs.

Let’s explore how WRITER can transform your claims management processes.

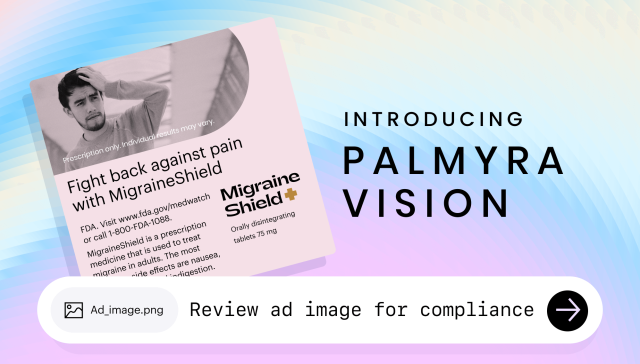

Save time on documentation with image analysis

Generate detailed descriptions of property damage from images and text descriptions provided by claims adjusters using an out-of-the box image analysis app. It uses Palmyra-Vision, the WRITER-built multimodal model with vision capabilities, to analyze and generate content based on your images. The image analyzer app can process handwritten text, graphs, infographics, and more. This speeds up the documentation process and ensures accuracy and consistency in reports.

Explore the image analyzer app

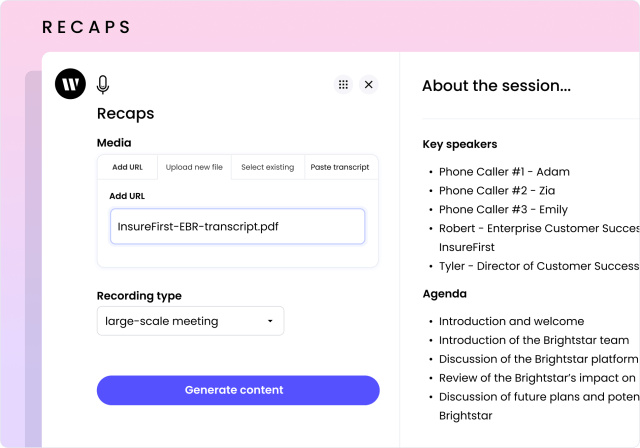

Make smarter, faster dispute decisions with customer call summaries

Efficiently summarize key details from call recordings relating to claims disputes. With the recaps app in WRITER, upload audio, video, or event transcripts and get a custom summary of the most salient points. This helps us capture the heart of the matter accurately and speeds up your review process, leading to faster decisions.

Uncover coverage discrepancies earlier with document analysis

Analyze claims documents to pinpoint discrepancies in coverage or claims history. The Knowledge Graph feature in WRITER can assist claims management teams in uncovering coverage discrepancies. It does this by accurately retrieving relevant data and providing a rich context through its retrieval-aware compression technique, ensuring that teams have the precise information they need to identify and address any discrepancies in coverage efficiently. Early detection of potential issues can help mitigate risk and streamline your claims handling process.

Accelerate the investigation process with Ask WRITER

Speeding up evidence compilation and witness analysis in claims management not only accelerates the resolution process, enhancing customer satisfaction with faster responses and settlements, but also slashes operational costs, boosts the accuracy and reliability of assessments, and curbs fraud and errors.

Documents mode in our chat interface, Ask WRITER lets claims teams upload, manage, and analyze specific files, like evidence and witness statements. This allows for more efficient research and drafting directly from the source material.

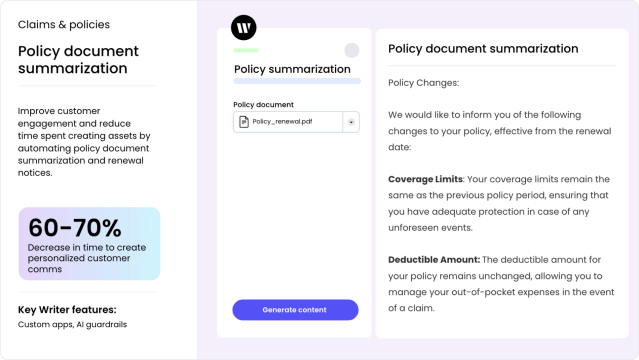

Improve customer experience with clear, tailored communications

Timely and clear updates enhance customer satisfaction and trust in the claims process. Improve the overall customer experience by using WRITER to speed up and standardize communications about policies and claims.

No-code tools in AI Studio let you build apps without writing any code to compress workflows like generating personalized policyholder comms. Simply define the required inputs, the instructions for the app to follow, and the desired output structure. Once you’ve built the app, deploy it and edit it at any time.

For more complex workflows that need more features and better connections with existing claims management systems, AI Studio has tools for developers like WRITER Framework and WRITER APIs.

Lead the change in insurance with generative AI for superior claims management

Every claim counts, and every customer’s satisfaction is pivotal. Generative AI isn’t just a tool — it’s a disruptor in the best possible way. Imagine transforming the mundane, error-prone tasks of claims processing into a streamlined, fraud-resistant, and compliance-guaranteed powerhouse. That’s the promise of generative AI. It’s not about replacing the human touch — it’s about enhancing it, allowing you to deliver on your promises faster and more efficiently than ever before.

Why just keep up when you can lead? With generative AI, you can elevate your operational efficiency and boost customer satisfaction to new heights. Think of it as turning your challenges into your biggest opportunities for growth and innovation.

The big book of generative AI insurance use cases

Read the guide

Ready to lead the change at your insurance company?

Dive deeper into what generative AI can do for you. Take a product tour or request a demo with WRITER today. Experience firsthand how generative AI is reshaping insurance claims management across the industry. Don’t just take our word for it — see how it’s already transforming businesses like yours.