Investors analyze earnings statements in calls to understand how a company is doing and make investment decisions. Bankers need to stay on top of earnings statements as they service clients and competitive positioning. Analysts have to review and analyze these every quarter. Generative AI can be used to detect, contextualize, and summarize subtle cues and sentiments expressed during company earnings calls, and over quarters or years, which are then used to drive insights on individual issuers or broader economic conditions.

Generative AI use cases for financial services

Introduction

Financial services has always been a deeply knowledge-driven industry. The entire value chain relies on a series of decisions that compile data about the market, the firm’s available products, and a client’s financial needs.

At the same time, financial services decisions aren’t based purely on data: There’s a lot of context involved. Whether it’s advising a private company on their IPO or personalizing portfolio recommendations to an individual investor, analysts and advisors are relying on a lot of information. This information is often complex, scattered, and ever-changing.

The typical banker, analyst, or advisor may spend hours researching and analyzing information. By comparison, generative AI can gather and analyze that context in a fraction of the time. Analysis from Deloitte suggests that generative AI can boost productivity for front-office employees by as much as 27-35% by 2026, after adjusting for inflation. KPMG reports that “60% of banks plan to use GenAI to bridge talent gaps and automate up to 20% of daily tasks” and “84% of [financial services] leaders anticipate increasing their investment in GenAI, aiming to extend its application and introduce it into new functions.”

“84% of [financial services] leaders anticipate increasing their investment in GenAI, aiming to extend its application and introduce it into new functions.”

But financial services is also a world that relies on a high degree of accuracy and regulatory compliance. For major financial institutions, this means implementing generative AI that relies on the firm’s wealth of internal knowledge while protecting customer and proprietary data.

Download the guide

Current industry challenges

While the financial services industry has always been competitive, the slowing global economy has introduced even more pressures. According to the 2024 Banking and Capital Markets Outlook report from Deloitte, firms have to deliver more value while also managing internal costs. Customer expectations have increased with the rise of open banking and data sharing between financial products and services. But a holistic picture and personalized recommendations come at a cost of time and effort, all while financial services firms are keeping a close eye on their bottom line.

Generative AI can meet these needs, providing the added value that customers are expecting. Strict regulations allow little room for error, or “hallucinations,” which some generative AI models produce. While no specific AI laws exist in the United States (yet), the Consumer Financial Protection Bureau and the SEC have already issued guidance. The agencies warn against using generative AI if the model’s biases harm consumers or place the firm’s interests above the customer’s interests.

For generative AI to meet the industry challenges of financial service firms, the models have to return highly accurate information. Without accurate data, there’s a downstream impact on overall adoption: Analysts and client-facing employees won’t use generative AI if they can’t trust the output. A company may sink a lot of time and money into generative AI adoption but never see meaningful results or ROI.

Research from Accenture predicts that industry roles most likely to benefit from generative AI include market research analysts, financial services sales agents, and marketing specialists. To make generative AI a worthwhile investment for these roles and others, companies need to seek products tailored to meet the specific needs and use cases of the financial services industry.

What does generative AI look like for financial services?

Generative AI is a combination of natural language processing (NLP) and machine learning (ML) technology. People have interacted with ML technology for a long time, like relying on search algorithms. The difference is that generative AI can create something new and original.

Generative AI relies on large language models (LLMs) that developers have trained on human data. The output — often text, though it can exist in other mediums like images and video — mimics human-generated content.

It can create or analyze content much faster than a human. For example, generative AI could summarize a 100-page document within minutes, saving a human hours of time reading and digesting the information.

Where generative AI falls short is when there’s no oversight. For financial services, in particular, generative AI needs human accountability. For proper risk management, companies should form an implementation team that represents multiple departments. Technologists and knowledgeable employees who can evaluate it should assess the output.

Financial service firms should identify business use cases. As a starting point, these should be critical business processes that are time-intensive and repetitive. From there, the implementation team should define the expected output and determine how to get that output every time. The only way to achieve the same result every time would be through using the right inputs (any available data) and the right prompts that guide the LLM to the right output.

How enterprise companies can map generative AI use cases for fast, safe implementation

Read the guide

Strategic use cases of generative AI for financial services by business function

Financial service firms review, analyze, and repackage large volumes of data, from earnings reports to client portfolio updates.

Generative AI can speed up many of these processes, allowing firms to scale and provide personalized client information.

Investment research

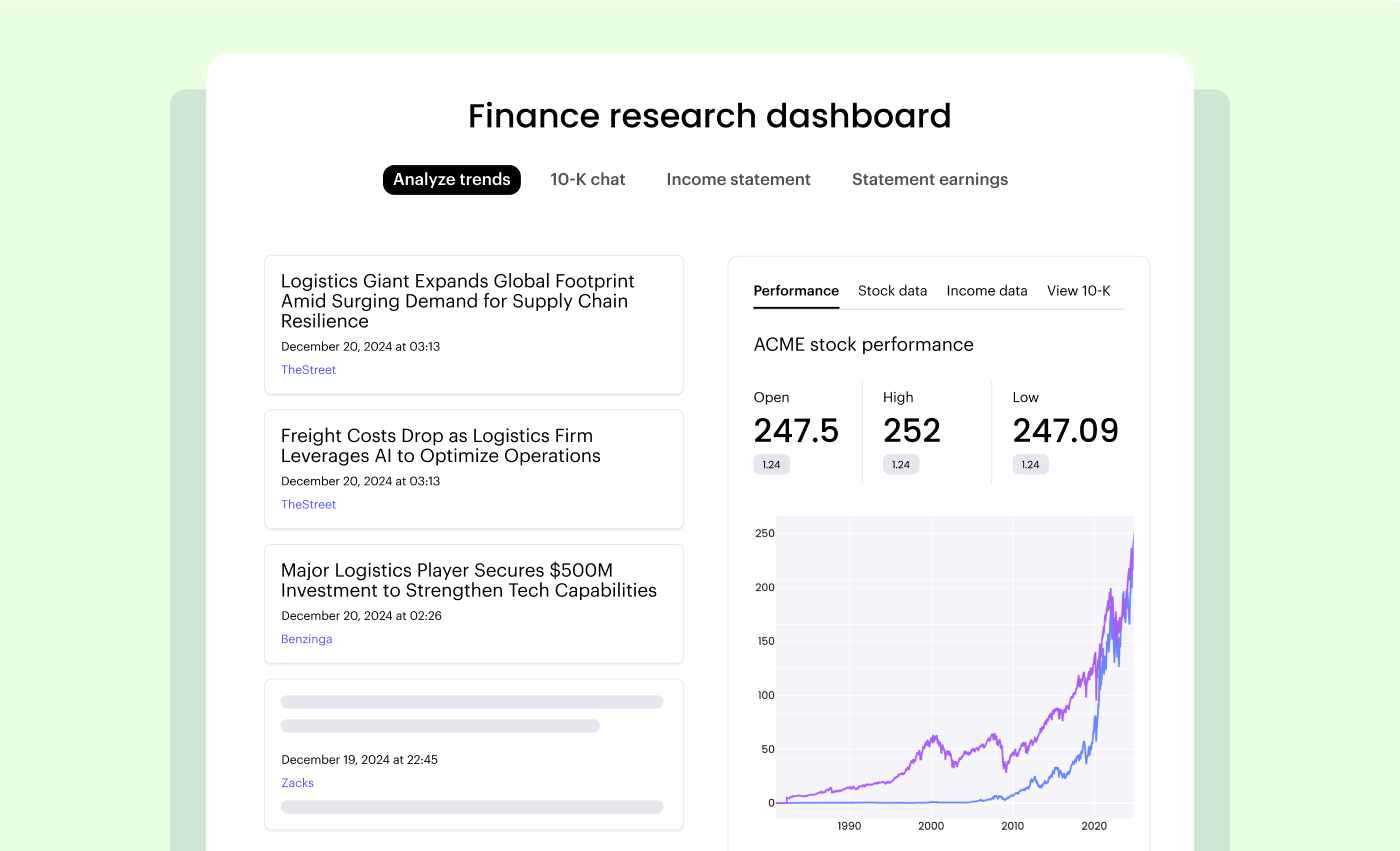

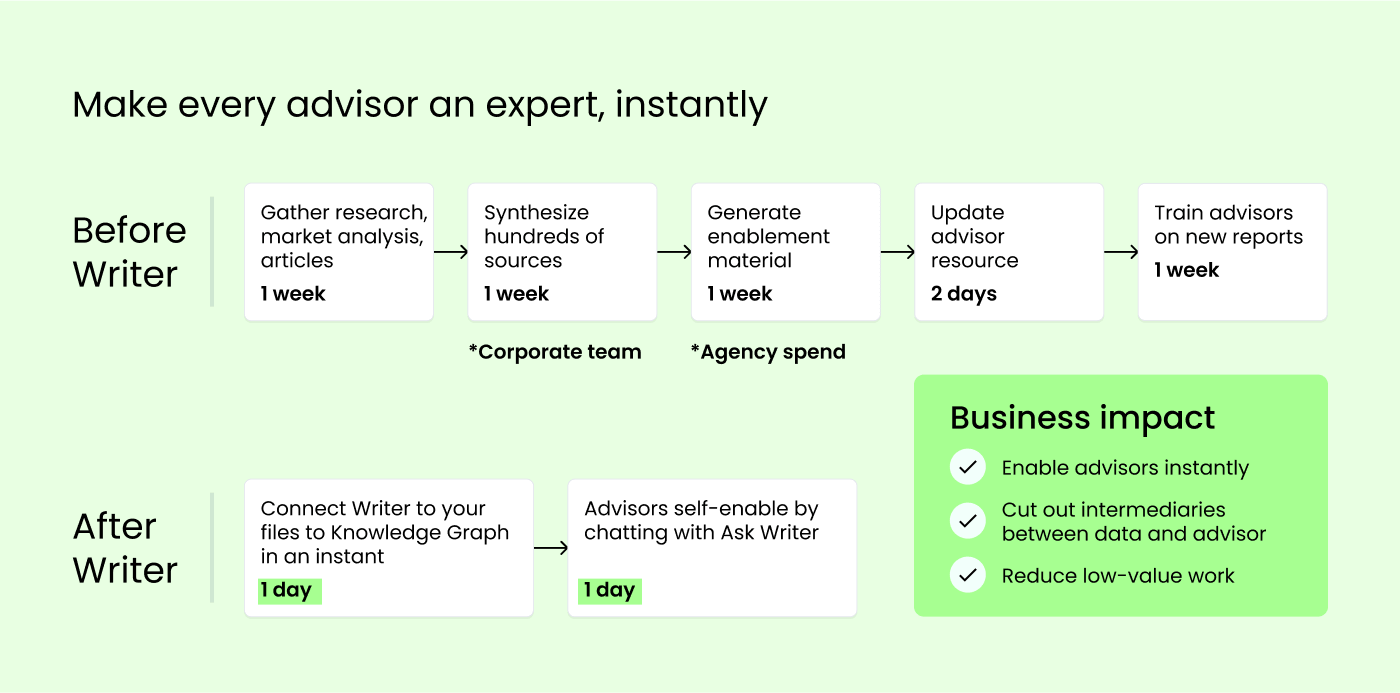

Investors and relationship managers must excel in two roles: understanding market trends and knowing how to apply them, either for investment decisions or to prepare insights for clients. Generative AI allows them to get answers faster by ingesting, analyzing, and synthesizing data. It’d take a human hours (or days) to complete the same work.

10-Ks/Qs need to be processed quickly by investment professionals as they contain stock-moving information. Generative AI can quickly summarize the key financials and management discussion points from a company’s latest 10-Q, 10-K, or S-1 reports.

All investment companies employ hundreds of researchers that share their investment ideas via email, internal systems, and investment memos. Being able to query and receive answers in natural language can save analysts hours every week so that they can refine their best ideas to make them more impactful.

Investor relations

Financial services firms are already relying on deep learning to analyze client portfolios for concentration risk. With the right deployment, generative AI can help relationship managers generate more detailed insights and personalize timely communications.

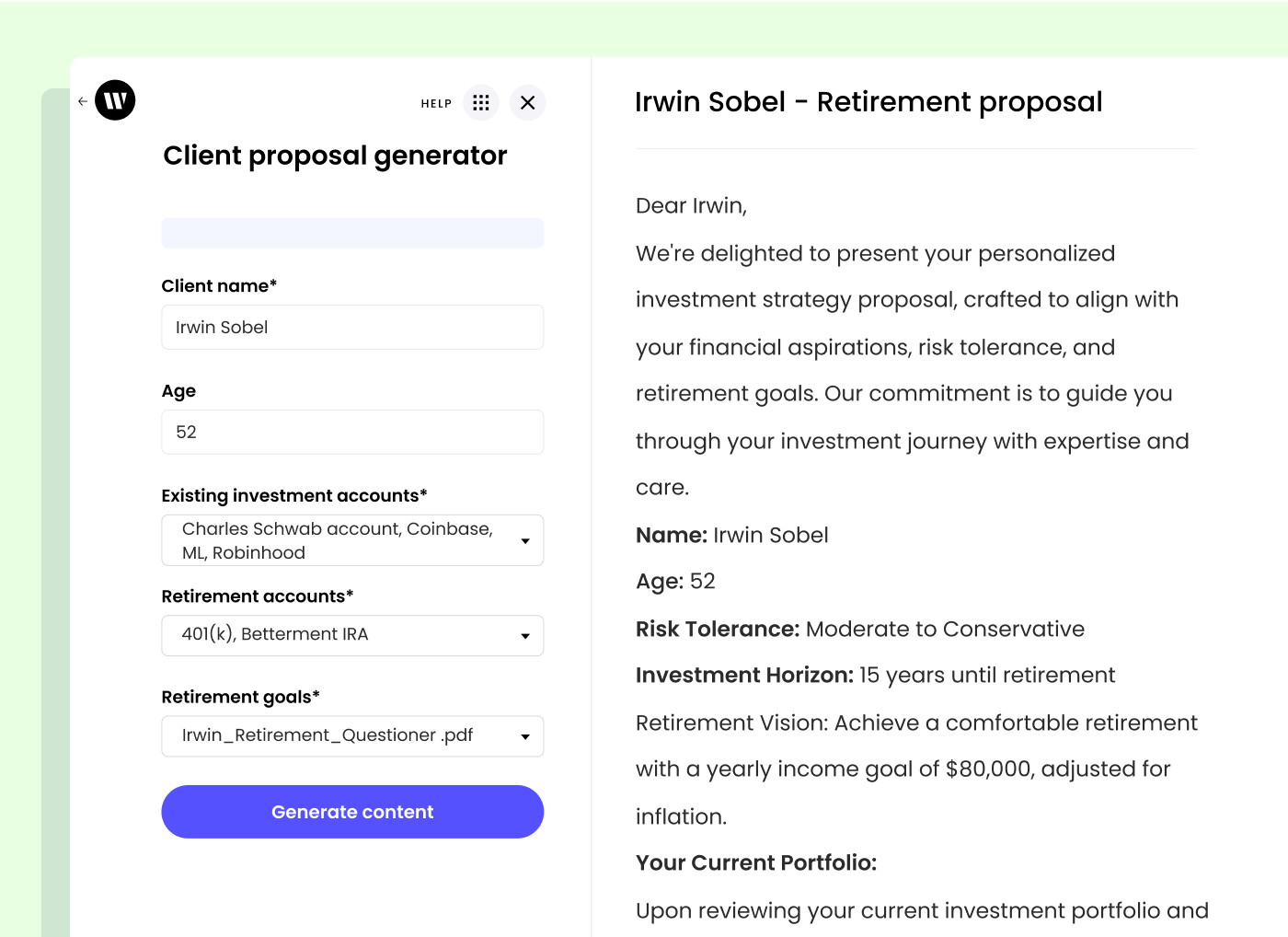

Written analyses and proposals are a lot of work for portfolio managers. Generative AI takes care of the heavy lifting, from preparing a proposal for a potential client to preparing initial commentary for an S-1 filing. Managers can provide the necessary background information with company or client profile data and then edit the generative AI draft.

Generative AI can automate the creation of comprehensive client history briefing memos by summarizing past interactions from calls, emails, and CRM notes. These memos include tailored recommendations for next steps, highlight at-risk relationships, and leverage current LinkedIn data to generate brief bios for external attendees. By integrating thought leadership, product collateral, and key client facts, AI helps financial advisors be well-informed and maintain strong client relationships even when team members leave.

Generative AI can streamline the preparation process for client meetings by automatically distilling firm insights and market data, providing a current view on stocks, and summarizing analyst views over time. An AI tool can prepare detailed briefs on top holdings, buys/sells, and market news, ensuring that the client relations team is well-informed and can speak confidently during meetings. By significantly reducing preparation time, AI allows teams to focus more on client engagement, enhancing the impact and quality of their interactions.

Wealth

Financial advisors run high-volume books of business and are time-constrained. They need to make sure that their clients are up to speed on what is happening in their portfolios. Clients ought to feel like they are getting a sufficient amount of personalized attention and client service. Automating this workflow with generative AI helps financial advisors focus on high-impact activities.

Ernst & Young notes that “deploying GenAI-powered solutions to support FAs will lead to more meaningful client engagement and will positively impact business growth through new client acquisition and increase wallet share of existing clients.”

Wealth managers can struggle to create personalized, compliant communications at scale for a diverse set of clients with varying financial literacy. Scaling tailored content for each client’s portfolio and demographics often leads to generic, less impactful outreach. Generative AI can transform this manual process and drive revenues by communicating with more clients in a meaningful way, and ultimately driving revenue.

Compliance

In the highly regulated financial services industry, generative AI improves compliance and efficiency by automating policy summaries, providing instant guidance, and streamlining KYC due diligence and guideline monitoring. It also empowers marketing teams to produce on-brand, compliant content quickly, reducing development time by over 50%.

Generative AI can centralize and summarize a firm’s compliance policies, making it easy for employees to get just-in-time information through natural language questions. For example, employees can ask, “Can I attend this dinner?” or “Do I need approval to buy X for my individual savings account?” and receive immediate, relevant policy highlights. This reduces the need for extensive policy reading, accelerates onboarding, and minimizes risk by encouraging frequent policy checks, ultimately saving firms significant time and resources and ensuring consistent adherence to regulatory requirements.

Generative AI can automate the creation of Periodic Customer Review (PCR) narratives for financial advisors, significantly reducing the manual effort required to compile and verify client information. By enforcing compliance checks and providing quick answers to KYC questions, AI ensures that reports are accurate, consistent, and free from common errors like typos and contradictions. This automation not only saves banks substantial resources and time but also helps mitigate regulatory risks and fines, improving overall client file review efficiency.

Generative AI can automate the review of client contracts and legal documentation, translating key information into compliance tools. It identifies important text, flags untestable or conflicting language, and maps compliance rules, reducing operational complexity and enhancing the client experience. This streamlined process provides meaningful insights and simulations, enabling clients to customize guidelines based on their risk tolerance and investment goals, ultimately maximizing investment opportunities and reducing time to market.

Marketing

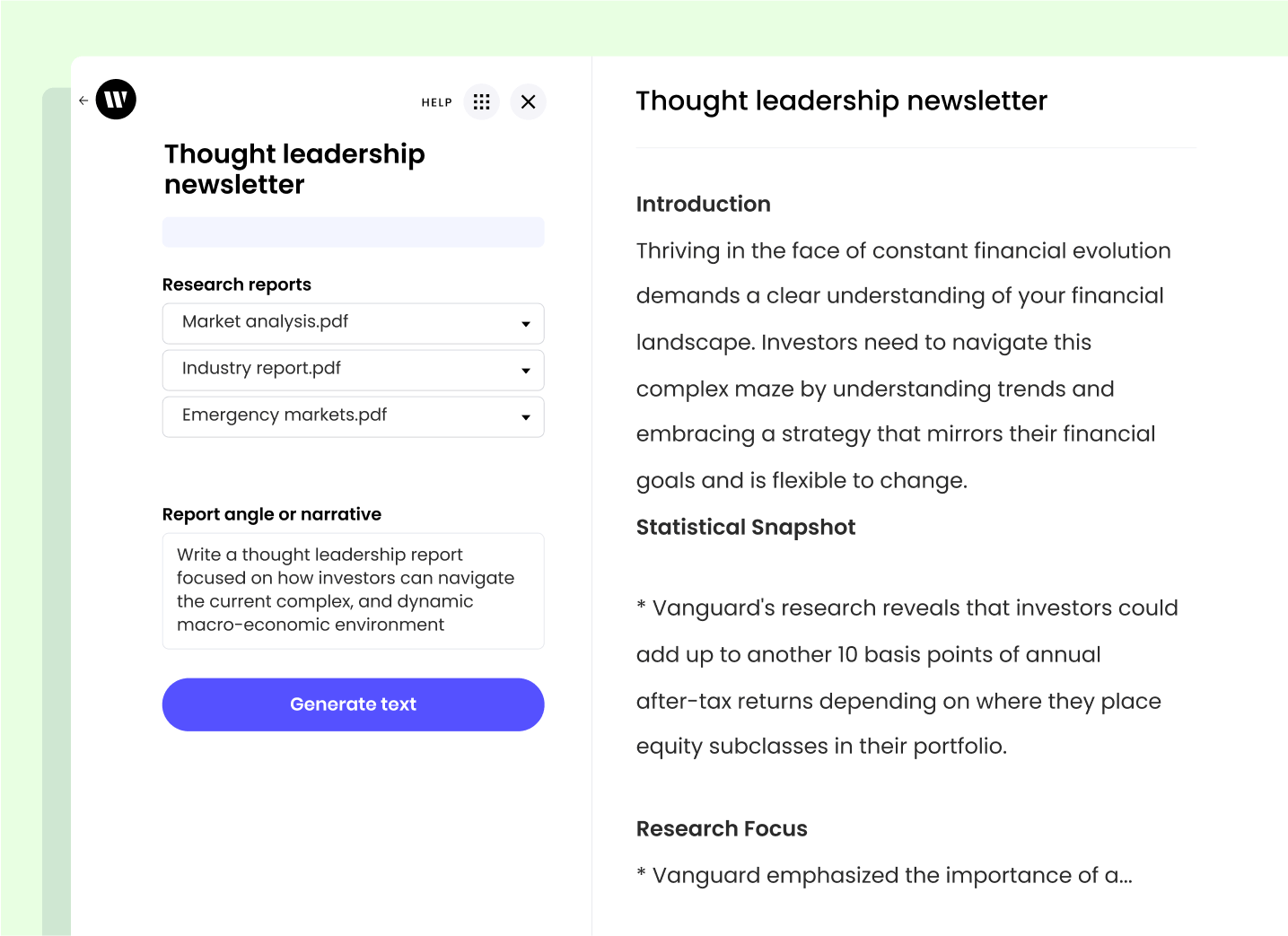

Marketing efforts must be on-brand while adhering to legal and compliance requirements. At the same time, content is also expected to provide deep industry insights or customer education, showcasing the firm’s expertise.

Marketing teams can move much faster and deliver greater insight with generative AI, for example, using internal analysis documents to feed thought leadership content, like blog posts or whitepapers. For example, the marketing team could publish an analysis of the headwinds major tech companies are facing, based on generative AI summaries of earnings calls from multiple companies, with commentary from analysts and investors.

Companies can also rely on generative AI to recap webinars or turn a longer piece of content into a quick summary for the company’s newsletter. Marketing teams can also use generative AI for message testing and audience personalization.

Generative AI can help enforce regulatory compliance across all written content, such as terms used. It also delivers on-brand messaging by comparing marketing assets to the company’s style guide. Marketing teams report a >50% reduction in the time spent developing marketing assets using the WRITER generative AI platform.

The generative AI solution landscape for financial services

For financial services firms, generative AI must integrate seamlessly with internal data — along with industry sources — to achieve the necessary context for accurate output. With this level of intelligence, companies can embed generative AI into their existing workflows, putting timely, valuable resources at employees’ fingertips.

Armed with this information, bankers, analysts, and advisors can serve more customers, provide more personalized and relevant updates, and demonstrate the company’s expertise.

Functional requirements

As you explore generative AI solutions, there are a few considerations you need to keep in mind to ensure a technology partner is well-suited for financial services. You’ll also want human oversight and processes.

- Financial expertise

Evaluate products with in-house financial expertise and domain-specific LLMs, such as the WRITER-built model Palmyra Fin. As an industry rooted in its expertise, generative AI output should match the terminology and credibility of an experienced financial advisor or analyst. - Outputs are reliable and accurate

Generative AI is known for hallucinating. Outputs should cite sources and deliver near 100% accuracy and become more accurate with use. - Connects with your data

Supplement the LLM with internal knowledge, including analysis documents and product information. This technology is called retrieval augmented generation, or RAG. - Adheres to regulatory guidance and requirements

AI solutions must comply with regulations, which include transparency around how the models make recommendations. - Maintains your style and tone

Generative AI output should follow your brand guidelines, including product descriptions and writing style. - Integrates easily into existing workflows

Users need easy access to generative AI, no matter what apps or tools they’re using. End users shouldn’t need to be prompt experts, but rather rely on pre-built workflows created by your organization. - Understands relevant data formats

Whether it’s a spreadsheet, a portfolio statement, a PDF, or trends data, the solution should be able to process multiple forms of data and provide the relevant output. - Detects claims and checks facts

Within the workflow, you should bring any unverified or inaccurate information to the user’s attention. - Protects data

The solution must meet privacy laws regarding the protection of consumer data and PII. - Meets security requirements of the organization

You should deploy the model in a way that maintains organizational control over the data and guarantees that sensitive company and customer data isn’t used to train the LLM.

How New American Funding supports its mission to democratize home ownership with generative AI

customer spotlight

Solution strategies

When integrating generative AI into financial services organizations, decision-makers can choose from three primary strategies:

- Developing a custom in-house AI stack

- Using AI point solutions

- Adopting a full-stack platform

1. Developing a custom in-house AI tech stack

This approach involves building a bespoke AI solution from the ground up or modifying pre-existing foundation models to suit specific organizational needs.

Advantages

Customization: Tailors solutions to fit unique business requirements of financial service organizations and workflows, improving operational efficiency.

Control over security: Maintains strict control over data management and model training, ensuring compliance with regulations.

Drawbacks

Resource intensity: Demands significant investment in time and expertise for development, integration, and application creation. It requires the efforts of dedicated Machine Learning engineers, who are always in short supply.

Delayed ROI: The time from development to operational deployment is considerable, potentially delaying benefits realization. These projects are often scoped to take months, and in practice take over a year before the first applications are in production.

Maintenance demands: Requires ongoing investment in system updates and feature enhancements, which is often a challenge for internal IT teams at financial services organizations. The Generative AI space moves fast, and solutions that start as “cutting-edge” feel obsolete in six months.

2. Using AI point solutions

This approach involves using standalone ‘wrapper’ applications that typically build on top of existing LLMs — or adding AI features to existing software. These apps aim to perform specific tasks and are great for incremental productivity and personal work.

Advantages

Task optimization: Highly efficient at addressing specific operational challenges, making them effective for targeted needs.

User-friendly: Generally easier to deploy and require less technical expertise, facilitating broader adoption across the organization.

Quick deployment: Pre-built solutions can be quickly configured and made operational.

Drawbacks

Limited customization: Offer less flexibility to tailor to complex or unique organizational needs compared to in-house systems.

Inconsistent governance: This may lead to fragmented standards and practices across the organization, complicating compliance and security management. The financial industry has strict information security requirements, and onboarding and managing many separate solutions is a major administrative burden.

Vendor dependence: Relies on third-party providers for updates and functionality, which limits control over the solutions.

3. Adopting a full-stack platform

A full-stack platform like WRITER provides a comprehensive generative AI solution that includes everything from foundational models to application layers, all integrated into a single solution.

Advantages

Comprehensive governance: Facilitates strict adherence to legal, regulatory, and organizational standards, reducing risk and ensuring compliance.

Industry specialization: Meets the needs of the financial services industry with an LLM trained on financial data, such as Palmyra-Fin — the leading model for financial benchmarks, enabling organizations to incorporate generative AI into their workflows

Knowledge retrieval: Connects users with organizational data for quick, accurate question-answering through graph-based RAG.

Custom workflow integration: Allows for the creation of custom AI applications, enabling tailored AI-driven processes across the organization through app integrations and APIs.

Enhanced security: Centralizes data and processes, reducing exposure across disparate systems and aligning with privacy regulations.

Ongoing support: Offers continuous updates and support, easing the burden on internal IT resources.

Drawbacks

Higher initial costs: Comprehensive solutions may require a larger upfront investment compared to standalone applications.

Future outlook of generative AI in financial services

No company can afford to fall behind with generative AI. This technology changes the narrative within organizations. They’re able to recognize speed and scale in ways that weren’t possible with human resources.

The best generative AI use cases will come from within your organization. The more users try, the more they’ll see the potential, and it’ll substantially change the trajectory of AI adoption.

But for financial services, it’s not about creating small experiments that may or may not work. Small experiments will take too long, and you’ll lose momentum internally among hundreds (if not thousands) of employees who’d benefit from generative AI.

Given the intense industry competition and economic pressures, generative AI has to be about creating a portfolio of bigger bets. If well implemented, they’ll pay off with substantial time savings and impact. Organizations can continue implementing new use cases — new bets — until they’re driving real change within the company.

Transform financial services with full-stack generative AI

Experience the future of generative AI in financial services with WRITER, the leading full-stack platform.

- A financial-specific LLM

- Augmented securely by your data

- Customized with apps and workflows for your use cases

- Supported by our AI program management

Leading financial companies like Vanguard and Franklin Templeton rely on the WRITER-built LLM, Palmyra Fin, built on a curated set of financial training data. Our highly accurate model can analyze market data, develop forecasts, produce detailed investment analyses, and help assess the risks of different financial tools or asset allocation strategies.

Business and IT users can create and deploy custom AI apps on the WRITER platform with our no-code and low-code tools, or partner with WRITER to have custom AI apps built for you.

Bring accuracy and compliance together.

Learn how WRITER can help financial firms like yours boost productivity by 27-35%.