AI agents at work

– 13 min read

Your inventory analysis takes three weeks. It should take three hours.

Can AI really solve inventory management challenges? After three years building supply chain optimization solutions at Adore Me and now working with retailers implementing agentic AI, here’s what actually works — and what doesn’t.

- AI agents are revolutionizing retail inventory management by shifting sluggish, manual processes to swift, data-driven decisions.

- Despite having advanced inventory management software, inventory teams struggle with slow analysis cycles, leading to missed sales and markdowns.

- AI inventory management solutions can act on discoveries immediately by instantly analyzing historical sales data, writing code for complex calculations, and combining quantitative and qualitative insights.

- By integrating with existing systems, retailers can benefit from AI agents, reducing manual data manipulation, and optimizing inventory levels and marketing strategies.

- AI cannot replace demand planners and inventory analysts, but it can augment their capabilities, offering faster, more actionable insights.

Every Monday at Adore Me, I watched our planning and inventory teams start the week with solid dashboards and respectable forecasts — yet the first question was always bigger than the numbers: “Which products are about to stock out, and what should we move first?” We weren’t flying blind; we had machine learning algorithms, Anaplan, and inventory planning systems. But time-to-insight and time-to-action were still too slow, and that lag showed up as missed sales and markdowns.

What I learned was this: even the best traditional inventory management software can’t close the gap between a question and a decision fast enough for today’s retail environment. Analyzing historical data through manual inventory management processes takes too long when market trends shift rapidly and customer demand patterns evolve daily.

That’s ultimately what pushed me toward agentic AI solutions—systems that can bridge that gap between data and decisions in ways traditional software simply can’t.

What are AI agents in inventory management?

Before diving into the specifics, let’s establish what we mean by “AI agents” in the context of retail supply chain optimization. Unlike traditional inventory management software that requires manual inputs and predetermined workflows, AI inventory management agents are autonomous systems that can perceive their environment, make plans, and take actions to achieve optimal inventory levels.

In inventory management, an AI agent can:

- Analyze historical sales data from multiple sources (POS, WMS, forecasting systems) without manual data preparation.

- Write and execute code (Python scripts, SQL queries) to perform calculations that would take analysts days.

- Predict future demand by combining quantitative analysis with qualitative insights about products, suppliers, and market trends.

- Automate routine inventory tasks beyond analysis — generating reports, sending alerts, even proposing purchase order adjustments.

Think of it as having a highly skilled analyst who never sleeps, can process vast amounts of business information instantly, and can immediately act on what they discover. The agent doesn’t replace human decision making — it accelerates time-to-insight and expands what’s possible in terms of analysis depth and speed.

For supply chain leaders, this represents a fundamental shift from reactive to proactive inventory management — but the real question is how this plays out in practice.

Why traditional inventory management systems fall short in 2025

“Can AI really solve inventory management challenges?” I get this question almost weekly now, and my answer has evolved. Six months ago, I would have focused on demand forecasting accuracy. Today, I focus on something else entirely — analysis paralysis.

The real issue isn’t that forecasts are wrong — it’s that by the time teams analyze why they’re wrong, it’s too late to do anything about it.

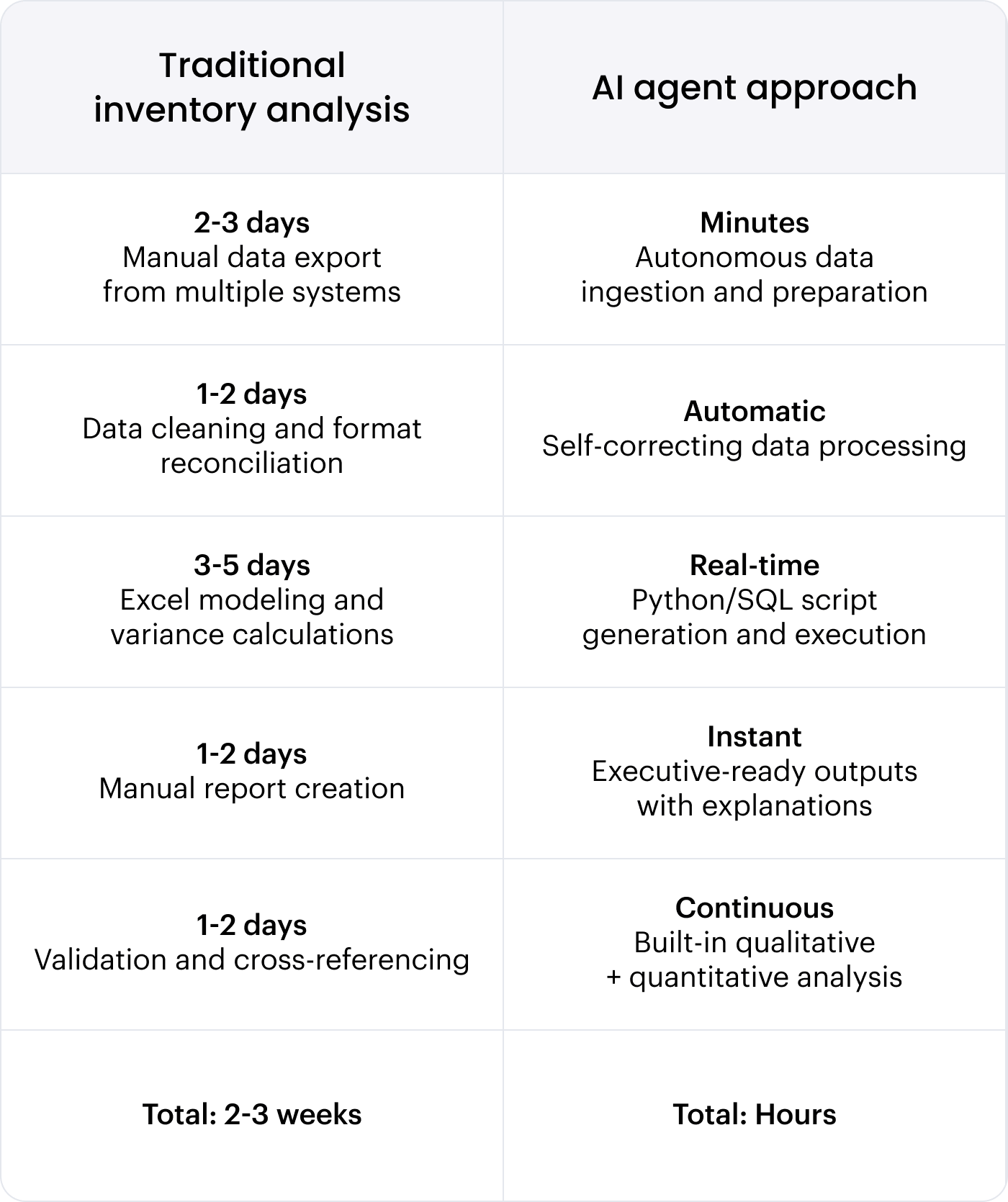

Consider this typical scenario I witnessed across multiple retailers using conventional inventory management processes:

- Data collection: 2-3 days exporting from POS, WMS, ERP systems

- Data preparation: 1-2 days cleaning formats, reconciling SKU naming

- Analysis: 3-5 days building Excel models, calculating variance metrics

- Reporting: 1-2 days creating executive summaries

- Validation: 1-2 days cross-referencing with business knowledge

Total cycle time: 2-3 weeks per major analysis

By the time insights land, reorder windows have closed. Purchase order cutoffs have passed. Market trends have shifted. Customer behavior has evolved. The inventory levels that made sense three weeks ago may no longer meet customer demand.

This delay in analyzing historical data means retailers are constantly playing catch-up instead of anticipating future demand patterns.

How AI inventory management agents actually work (beyond the hype)

After speaking with dozens of supply chain leaders this year, one question comes up in every conversation — usually right after I mention AI agents: “What’s the difference between AI-powered inventory management and traditional forecasting software?”

Here’s what I’ve learned from watching teams implement both — the difference isn’t about better predictions. It’s about operational efficiency and analytical depth. Let me show you what an inventory agent actually does that traditional inventory tracking systems can’t:

Real-time data interrogation without IT tickets

Instead of waiting weeks for custom dashboards, planners can ask — “Which A-rank SKUs have forecast errors above 30% and current weeks-of-cover below safety stock?” The agent writes Python scripts, connects to your existing systems, and returns ranked action lists — in minutes. This dramatically improves customer satisfaction by preventing stockouts of high-priority inventory items.

Quantitative + qualitative analysis in one workflow

Traditional AI tools excel at structured data but miss crucial context. An AI inventory agent can identify that “we’re consistently over-forecasting this ingredient family” by analyzing both numerical variance patterns and unstructured product attributes like supplier regions, material types, or seasonal categories. This helps optimize stock levels by understanding the root causes of forecasting errors.

Self-correcting analysis without manual intervention

When data formats change or calculations hit edge cases, the agent detects errors, revises its approach, and delivers clean results. No analyst time spent debugging formulas or reconciling conflicting spreadsheets. This saves time and reduces human error while providing valuable insights.

AI agent integration with existing inventory management systems

Last month, I was on a call with a retailer’s supply chain team when their director asked: “Can AI agents actually integrate with our existing systems like Anaplan, or is this just another rip-and-replace situation?”

It’s a smart question — and one I hear constantly. Most retailers have invested heavily in inventory management software and aren’t looking to start over. Here’s a real example that shows how this integration actually works:

I recently worked with a fast-growing beauty brand — let’s call them BeautyBrand — facing exactly this integration challenge. They’d just implemented Anaplan after years on spreadsheets, but their Director of Supply Chain Operations had a practical request:

“Compare our July forecast snapshot to August, calculate 12-month variance by SKU and region, flag anything over 30% change, then factor in current stock levels and incoming POs to prioritize interventions.”

Here’s a look at the two approaches:

The traditional approach (2-3 week cycle)

This is the timeline that most supply chain teams are painfully familiar with:

- 2-3 days — Manual data export: An analyst pulls forecast data from Anaplan, sales data from the POS system, inventory data from the WMS, and PO data from the ERP.

- 1-2 days — Data cleaning and reconciliation: The analyst manually matches SKUs across different systems, standardizes date formats, and cleans up inconsistencies in Excel.

- 3-5 days — Excel modeling and variance calculations: The core analysis happens in a massive spreadsheet. The analyst builds formulas to calculate the variance, flags SKUs over the 30% threshold, and then layers in on-hand and incoming inventory.

- 1-2 days — Manual report creation: The analyst manually creates charts and summaries in PowerPoint to present the findings to leadership.

- 1-2 days: Validation and cross-referencing: A manager or another analyst reviews the report to check for errors, a necessary but time-consuming step due to the manual nature of the work.

Total estimated timeline: 2-3 weeks.

The AI-powered approach (The 2-hour cycle)

This is how an AI inventory management agent handles the same request:

- Data connection (minutes for initial setup): The agent uses pre-built connectors to securely access data directly from BeautyBrand’s existing systems.

- Autonomous analysis (minutes to hours): The Director gives the agent the same natural language prompt. The agent autonomously writes and executes the necessary Python scripts, performs the data cleaning, calculates the variance, flags outliers, and incorporates inventory and PO data into a single, seamless workflow.

- Automated report generation (minutes): The agent generates a detailed PDF report with clear visualizations, a prioritized list of at-risk SKUs, and explanations for its recommendations.

Total actual timeline: 2 hours

The agent identified that their best-selling concealer (A-rank SKU) had 8% forecast variance, an average weekly volume of 11,000 units, and 52 weeks of total projected demand. More importantly, it flagged which months showed the biggest variance and calculated current weeks-of-cover under both old and new forecasts.

The breakthrough wasn’t the calculation — it was the speed and the ability to immediately ask follow-up questions. This real-time visibility into inventory performance enables proactive decision-making instead of reactive firefighting.

ROI of AI-powered inventory optimization

I was in a meeting last week when the CFO leaned forward and asked the question I knew was coming — “What’s the actual ROI of AI-powered inventory optimization? Show me the numbers.”

Fair question. Every supply chain investment needs to justify itself. Here’s how I’ve learned to frame the financial impact, based on what I’ve seen work in practice:

Stockout revenue impact

- A-rank SKUs: Target 99% availability. One week stockout might be acceptable — two months is a crisis

- Long lead times (4-9 months in beauty/fashion): Early signal detection is everything

- Revenue protection: Fast identification of imminent out-of-stocks allows redistribution before customers notice

Carrying cost optimization

- Overstock identification: Which SKUs exceed demand tolerance by category and location

- Markdown strategy: Simulate price/pack/promo options to minimize margin impact

- Working capital efficiency: Free up cash tied to slow-moving inventory

Marketing-inventory misalignment

- Media waste reduction: Stop advertising stockouts or overstocked, low-margin SKUs

- Budget reallocation: Shift spend toward available, high-margin categories

- Performance optimization: Align demand generation with supply capability

The hidden cost most retailers miss: analyst time consumed by manual data manipulation instead of strategic decision-making. AI technologies free up this valuable resource for higher-impact work that drives business growth.

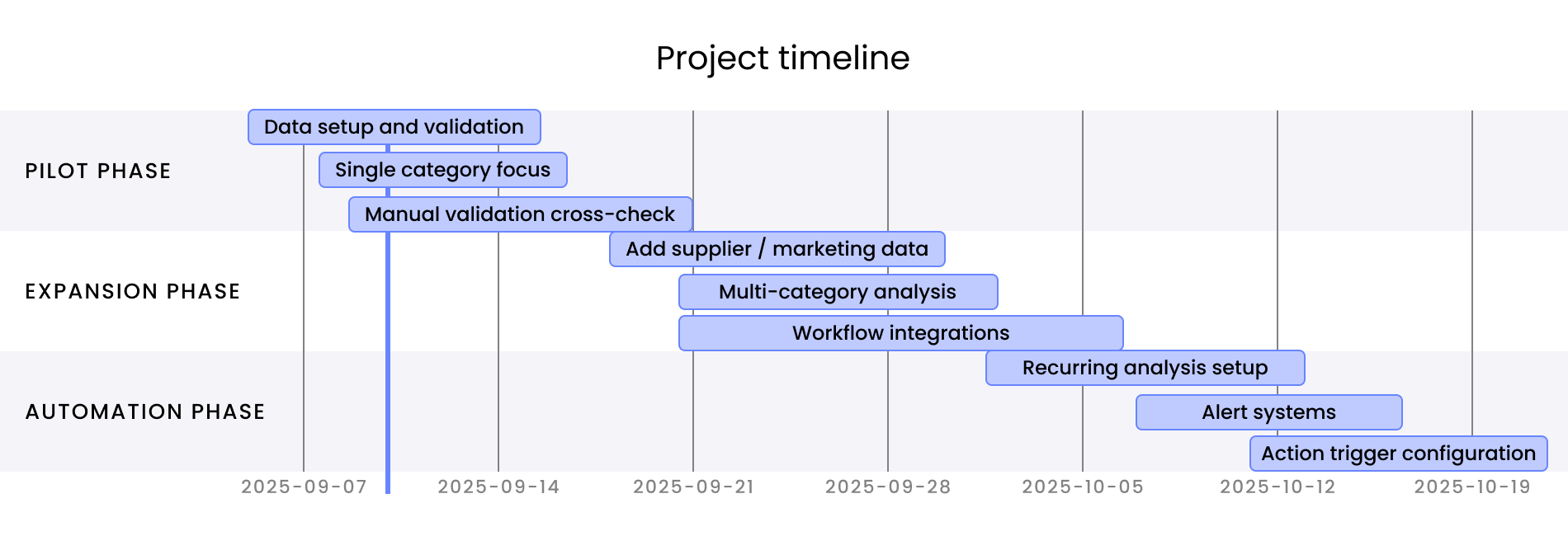

AI inventory management implementation timeline

During our pilot with BeautyBrand, their VP of Operations pulled me aside — “How long does this actually take to implement? And please don’t give me vendor timeline — give me the real timeline.”

I appreciated the directness. Based on what I’ve seen across multiple deployments, here’s the honest timeline for implementing AI in inventory management:

Week 1-2: Pilot focused analysis

- Scope: Single category or region

- Data: Forecast snapshots, current stock, incoming POs

- Output: Forecast variance analysis with weeks-of-cover calculations

- Validation: Cross-reference with planning team’s manual calculations

Week 3-6: Expanded context and routing

- Enhancement: Add supplier attributes, marketing spend data

- Workflow: Route recommendations to appropriate owners (planning, merchandising, performance marketing)

- Integration: Connect to existing data warehouse (Snowflake, BigQuery)

Week 7-12: Automated recurring insights

- Standardization: Weekly/monthly analysis runs

- Escalation: Automated alerts for critical thresholds

- Action triggers: PO adjustment proposals, campaign pause/restart recommendations

Agentic AI adoption: A leader’s roadmap to enterprise governance and AI training for employees

Learn More

Critical success factor: Start with existing data formats and proven use cases, then expand — don’t try to rebuild your entire planning process on day one.

Will AI replace demand planners and inventory analysts?

After showing a demo to a planning team last month, one of the senior analysts asked what I think is the most important question — “Is AI going to replace demand planners and inventory analysts?”

The room went quiet. It’s the elephant in every conversation about AI in inventory management. Here’s what I told them, and what I’ve seen play out in practice:

Not even close. What struck me at Adore Me wasn’t the absence of technology or talent — it was watching talented teams wrestle with the limits of even good AI systems. They had data, but not the intelligence and speed to connect it into confident decisions.

Today, those same teams can begin Monday mornings with an agent-generated map of risk and opportunity — which SKUs and suppliers need attention, where forecasts exceed tolerance by rank, and which POs to adjust before cutoffs expire.

The practical promise isn’t perfect demand forecasting — it’s faster, more informed decision-making at scale. AI-driven insights augment human expertise rather than replacing it, enabling teams to focus on strategy while AI inventory systems handle routine tasks.

Questions every supply chain leader should ask about AI inventory solutions:

- “How do you ensure consistent methodology across different analysts?” (Agents standardize analysis approaches while allowing custom business rules)

- “Can this integrate with our existing tech stack without ripping and replacing core inventory management software?” (The answer should be yes — agents work alongside Anaplan, NetSuite, and existing warehouses)

- “How do you handle data quality issues and edge cases?” (Look for self-correcting capabilities, not just pretty dashboards)

- “What’s the minimum viable use case to prove value?” (Start with forecast variance analysis on your most critical inventory items)

Five ways AI vendors should support the adoption process

Learn More

Ready to see inventory management agents in action?

The difference between reactive and proactive inventory management isn’t about AI sophistication — it’s about time-to-insight and time-to-action.

Start with a focused pilot

Based on what I’ve seen work across multiple retailers, the best place to start is simple:

- Two forecast snapshots

- Current inventory levels

- Incoming POs

- SKU rankings

- Lead times

The right system will return a ranked action list with explanations you can pressure-test in your next planning meeting.

WRITER’s enterprise-ready approach

WRITER’s inventory management agents take this exact methodology and make it enterprise-ready. Our agents can:

- Analyze complex datasets from multiple sources simultaneously

- Write and execute code to perform calculations that typically take analysts days

- Combine quantitative analysis with qualitative insights about your products, suppliers, and market conditions

What sets WRITER apart

End-to-end platform integration: You’re not getting a point solution that creates new silos. Instead, you get agents that integrate with your existing inventory management software while providing enterprise-grade controls:

- Seamless integration with Anaplan, Snowflake, NetSuite

- Governance and security controls for enterprise teams

- Scalability that grows with your business needs

Proven benefits for retailers

The numerous benefits include:

- Cost reduction through optimized inventory levels

- Improved operational efficiency across planning teams

- Enhanced customer satisfaction through better stock availability

- Trend identification that might otherwise go unnoticed

- Reduced carrying costs while meeting customer demand

See real results

WRITER’s inventory management agents in action: Check out real examples of how retailers are using our agents to:

- Compress 3-week analysis cycles into same-day insights

- Identify forecast variance patterns across thousands of SKUs

- Automatically generate actionable recommendations with full transparency

Your next steps

From there, you can expand to supplier performance analysis and marketing context, layer in the workflows that make sense for your business needs, and watch Monday mornings become a lot calmer.

The future of inventory management isn’t about replacing human expertise — it’s about amplifying it with AI technologies that handle routine inventory tasks while humans focus on strategic decisions that drive business growth.

Ranjan Roy is the Industry Lead for Retail Solutions at WRITER, where he helps global brands implement AI agents that solve real business problems. Previously, he served as VP of Strategy at Adore Me, where he helped scale the company from $70M to $300M+ in revenue while pioneering the use of WRITER’s AI platform in retail operations.